All Categories

Featured

Table of Contents

According to SEC authorities, existing CDAs have actually been signed up as securities with SEC, and for that reason are covered by both government protections legislations and regulations, and state insurance coverage laws. At the state degree, NAIC has developed state disclosure and viability regulations for annuity products. States vary on the degree to which they have actually taken on these annuity regulations, and some do not have securities at all.

NAIC and state regulators told GAO that they are presently reviewing the regulations of CDAs (savings annuity). In March 2012, NAIC began examining existing annuity policies to identify whether any modifications are required to attend to the one-of-a-kind item layout functions of CDAs, including possible adjustments to annuity disclosure and viability criteria. It is additionally examining what type of resources and reserving requirements might be required to aid insurers manage item risk

Fixed Annuities Interest Rates

Both concur that each state will certainly have to reach its own conclusion regarding whether their certain state guaranty fund laws permit CDA coverage. Until these regulative concerns are dealt with, customers may not be totally shielded. As older Americans retire, they may face increasing health and wellness treatment costs, inflation, and the risk of outlasting their properties.

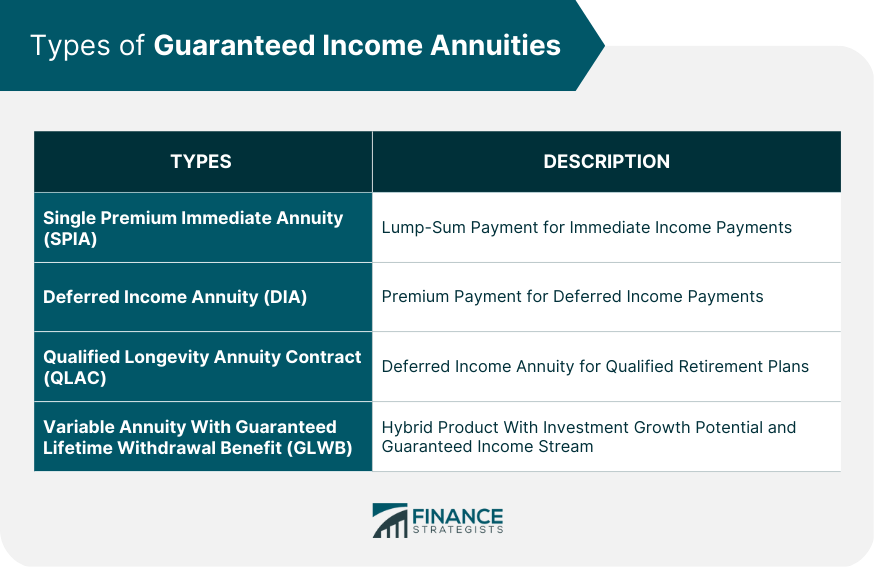

Life time income items can assist older Americans guarantee they have income throughout their retirement. VA/GLWBs and CDAs, two such items, may give unique advantages to consumers. According to market participants, while annuities with GLWBs have been marketed for a variety of years, CDAs are reasonably brand-new and are not commonly offered.

GAO gave a draft of this record to NAIC and SEC (lifetime annuity income calculator). Both given technical comments, which have actually been resolved in the report, as suitable. For even more information, get in touch with Alicia Puente Cackley at (202) 512-8678 or

It ensures a fixed rates of interest annually, no matter of what the stock exchange or bond market does. Annuity guarantees are backed by the financial stamina and claims-paying ability of American Financial savings Life Insurance Firm. Security from market volatility Guaranteed minimal rates of interest Tax-deferred cash accumulation Ability to prevent probate by designating a recipient Option to turn part or all of your annuity right into an earnings stream that you can never ever outlast (annuitization) Our MYGA offers the very best of both worlds by assuring you never lose a cent of your principal financial investment while concurrently assuring a rates of interest for the preferred time period, and a 3.00% assured minimum interest price for the life of the contract.

The interest price is guaranteed for those abandonment cost years that you choose. We have the ability to pay above-market rates of interest because of our below-average expenses and sales expenditures as well as our regular above-average financial performance. 1-Year MYGA 5.00% 2-Year MYGA 5.25% 3-Year MYGA 5.25% 4-Year MYGA 5.25% 5-Year MYGA 5.25% 10% Annual Penalty-Free Withdrawal Biker (no charge) Penalty-Free Survivor benefit Biker (no charge) Penalty-Free Persistent Ailment Motorcyclist (no charge) Penalty-Free Terminal Health Problem Biker (no charge) Penalty-Free Nursing Home Arrest Cyclist (no cost) Multi-Year Guaranteed AnnuityAn Individual Single Premium Fixed Deferred Annuity Rates Of Interest Options(Rate of interest differ by thenumber of years picked) 1-Year: 1-year surrender charge2-Years: 2-years abandonment charge3-Years: 3-years surrender charge4-Years: 4-years give up charge5-Years: 5-years surrender charge Concern Ages 18-95 years old: 1 or 2 years durations18-90 years old: 3, 4, or 5 years durations Concern Age Resolution Current Age/ Last Birthday Minimum Premium $25,000 Optimum Premium $500,000 per private Rate Lock Allocations For circumstances such as individual retirement account transfers and IRC Section 1035 exchanges, an allocation may be made to lock-in the application date interest rateor pay a higher passion price that may be readily available at the time of issue.

Withdrawals are subject to ordinary revenue tax obligations, and if taken prior to age 59-1/2 may incur an additional 10% federal penalty. Neither American Cost Savings Life nor its manufacturers offer tax obligation or legal advice.

Immediateannuities.com

These payout rates, which include both interest and return principal. The rates represent the annualized payout as percent of total costs. The New York Life Clear Earnings Benefit Fixed AnnuityFP Collection, a set deferred annuity with a Guaranteed Life Time Withdrawal Advantage (GLWB) Cyclist, is issued by New York Life Insurance and Annuity Corporation (NYLIAC) (A Delaware Corporation), a wholly possessed subsidiary of New York Life Insurance Firm, 51 Madison Avenue, New York, NY 10010.

All assurances are dependent upon the claims-paying ability of NYLIAC. There is a yearly biker fee of 0.95% of the Build-up Worth that is deducted quarterly. Based on the life with cash refund choice, male annuitant with $100,000.

A guaranteed annuity rate (GAR) is an assurance by your pension service provider to provide you a specific annuity price when you retire.

Annuity Specialists

, which can additionally offer you a much better price than you 'd typically get. And your guaranteed annuity may not consist of features that are essential to you. annuity specialists.

A guaranteed annuity price is the rate that you get when you purchase an assured annuity from your supplier. This influences just how much income you'll get from your annuity when you retire. It's great to have an ensured annuity price since it can be much greater than present market rates.

Surefire annuity prices can go as high as 12%. That's approximately double the finest prices you'll see on the market today.

Annuities From Insurance Companies

If you pick to move to a flexi-access pension plan, you might require to talk to a monetary adviser. There might likewise be restrictions on when you can set up your annuity and take your guaranteed price.

It's a detail that typically obtains buried in the fine print. guaranteed income estimator. Your carrier might call it something like a 'retired life annuity agreement', or refer to a 'Area 226 policy', or simply discuss 'with-profits', 'advantages', 'preferential' or 'assure' annuities. To find out if you've got one, the finest point to do is to either ask your provider directly or check with your economic consultant.

This is a fatality advantage option that switches your annuity payments to an enjoyed one (normally a companion) for a particular amount of time up to 30 years - when you die. An annuity guarantee duration will offer you peace of mind, yet it likewise indicates that your annuity income will certainly be a little smaller.

If you select to transfer to one more company, you may shed your ensured annuity price and the benefits that feature it. Yes - annuities can come with a number of different kinds of warranty. what is annuity policy. All annuities give you a surefire income. That's what makes them so valuable when you're preparing your retirement.

Annuity Agents

That can make points a little complicated. As you can visualize, it's very easy to state an ensured annuity or a guaranteed annuity price, suggesting a guaranteed revenue or annuity guarantee duration. Ensured annuity rates are actually really different from them. So when individuals or firms start discussing annuity assurances, it is necessary to see to it you understand precisely what they're describing.

Table of Contents

Latest Posts

Decoding How Investment Plans Work Everything You Need to Know About Choosing Between Fixed Annuity And Variable Annuity Breaking Down the Basics of Variable Vs Fixed Annuities Pros and Cons of Pros A

Breaking Down Fixed Vs Variable Annuity Pros Cons A Comprehensive Guide to Investment Choices Breaking Down the Basics of What Is Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of Diff

Decoding How Investment Plans Work A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Advantages and Disadvantages of Fixed Vs Variable Annuities Why Immediate Fixed An

More

Latest Posts